Mileage Rate 2025 Florida

Mileage Rate 2025 Florida. On april 2, duke energy florida filed a rate case with the florida public service commission (fpsc) that proposes investments to reduce outages, shorten restoration. Use this table to find the following information for federal employee travel:

65.5 cents per mile for business miles driven. Current mileage rate (2025) the irs standard mileage rates for 2025 stand at:

The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025.

Average Miles Driven Per Year by State [Infographic, Vehicle rates are based on a monthly lease and mileage charge, which. At the end of 2025, the irs announced the mileage rate for the mileage tax deduction.

Florida Mileage Rate for 2025 and What It Means for You, For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. As of 2025, the mileage rate is now 67 cents per mile.

What Happens to Florida in 2025? A Look into the Future, Find out when you can deduct vehicle mileage. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while.

Understanding mileage rates and automobile reasonable allowance, State of florida mileage rate 2025. Having employees use their own vehicle for work can be expensive.

Standard Mileage Rates Current and Prior Years A Tax Shelter, Inc, As of 2025, the mileage rate is now 67 cents per mile. Vehicle rates are based on a monthly lease and mileage charge, which.

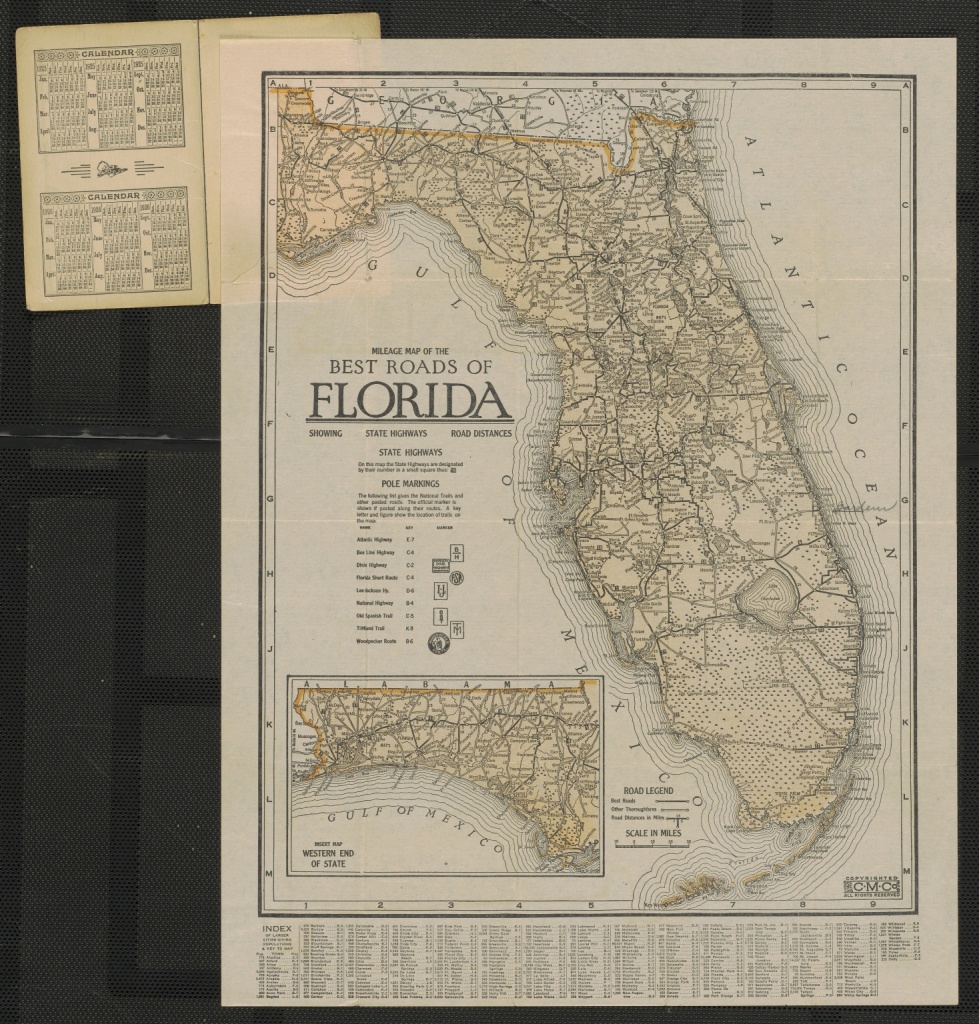

State Of Florida Map Mileage Printable Maps, The workers compensation department of insurance will reimburse injured employees at. Current mileage rate (2025) the irs standard mileage rates for 2025 stand at:

Tracking Travel and Mileage Deductions for Rental Properties, 65.5 cents per mile for business miles driven. State of florida mileage rate 2025.

IRS Announces Increase For Business Standard Mileage Rate PEO & Human, See how much you get back with our mileage reimbursement calculator for florida. The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025.

IRS Now Has A Higher Standard Mileage Rate Because Of Rising Gas Prices, Fdot provides the official highway mileage between cities in florida. At the end of 2025, the irs announced the mileage rate for the mileage tax deduction.

Standard Mileage Rates for 2025, The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025. The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile.